One of our top goals in any consulting engagement is uncovering revenue and profit growth opportunities for clients. Generally, we want to answer four key questions:

- How much opportunity is there? Accordingly, how hard should we work to capture it?

- Where is it coming from? Is it concentrated in a given geographic region or business unit, and is it coming from a specific sales discount category or channel?

- What is the root cause of the problem? Data analysis alone can tell you the “what” but not the “why”

- How will we create a roadmap to capture the opportunity?

To answer these questions, we need different types of analysis and fact finding.

Crunch the Data

The “what” and the “where” are answered with very quantitative tools. Transaction level or sales data analysis is a gold standard that we conduct with almost every customer.

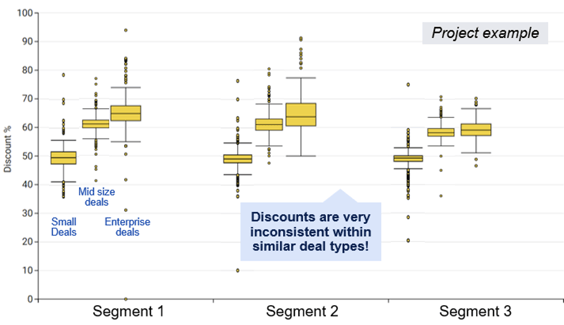

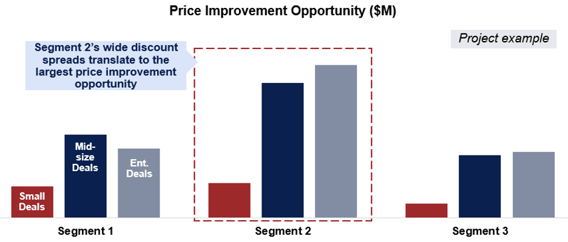

In a recent pricing project with a technology hardware manufacturer, we carefully created a baseline product segmentation to better understand a discounting problem. This ensured that analysis was being applied at the correct level. At the most granular level, we identified the low paying customers within a category via interquartile analysis.

We then determined the quantitative value of improving price for an achievable selection of low paying customers to fair price points that are observed and paid by other customers. Just because a customer is paying a low price does not mean they value your product or service at that low price point. For other customers who are unwilling to pay higher prices, it’s still important to align product tiers and service levels with prices to provide credibility and negotiating levers for your commercial teams.

Uncover the “Why”

The shortfall of data analysis alone is that it rarely points to the “why,” the root cause, or the “how” of capturing that opportunity. For this, we turn to a more qualitative analysis. This is particularly true in a B2B organization, where prices are negotiated on a deal-by-deal basis and it's rarely the case that a list price is adjusted and then realized prices reflect that same degree of change.

Uncovering the “why” involves a broad review of major organizational pricing policies, sales processes, and technology. This review is supplemented by interviews with key functional leaders across product, marketing, finance, and pricing. It's also supplemented by customer interviews and/or market research to uncover the real reasons why customers value your products and services.

Said another way, it's easy to confuse the concept of "statistical relevance" with "business relevance." During this phase, we’re not necessarily looking for a large customer “n” count or a specific R2 value; we need to uncover the core reasons that customers purchase from us or our competitors and use that insight to make better decisions.

Chart the course

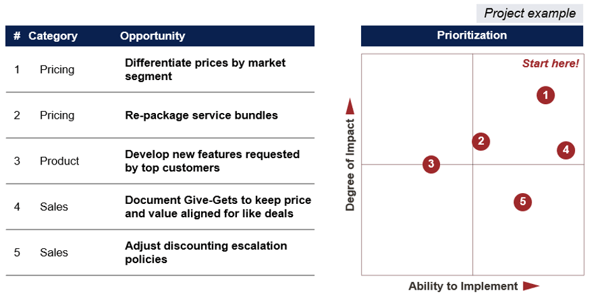

Typically, multiple levers are identified that could be pulled to impact price realization, but no organization has the bandwidth to pursue everything at once. Each of these levers must be prioritized in a structured way based on their degree of impact and the ability of the organization to implement the recommended change. The combination of impact and feasibility are used to create a roadmap that consists of detailed steps, who is responsible for each action, and on what timeline.

The bottom line is that many of our clients understand the "what" and "where" using quantitative tools to study their data. What’s typically lacking is the "why" and "how" that comes from qualitative analysis and speaking with customers to form a connection between purchase drivers and purchasing behavior. It’s critical to leverage a diversified set of analysis to craft a complete picture of the revenue and profit growth opportunities for your organization.

.jpg)