Dynamic pricing is a hot topic right now. With the advent of big data and IT quoting systems, many businesses are excited at the prospect of charging each customer at their willingness to pay for their product, rather than a flat or segmented price. As Bob Crandall, former CEO of American Airlines once put it “If I have 2,000 customers on a given route and 400 prices, I’m obviously short 1,600 prices." Think of all that money you’ve been leaving on the table with regular segmentation; if you could grab that, your profits would go through the roof!

Not so fast! If you work in B2B markets, chances are you already do personalized pricing. Unfortunately, you are not the one in control. In industries where most purchases go through a negotiation, sales often feels they have to give way on price to make the deal. This is especially true in mature markets where procurement takes control of proceedings and shakes the sales person down, telling them competition are offering lower prices and they better sharpen their pencil if they want to make the deal.

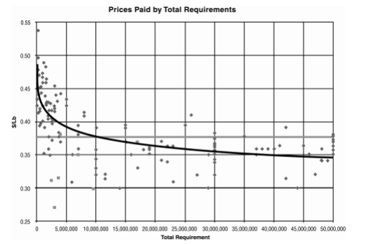

To uncover whether or not this is the case in your company, we suggest putting together a price plot. Simply plot realized price against some measure of the sale of your product, for example price versus volume. If you are like most of companies when we first start working with them, this will resemble a shot gun blast. It is then generally a simple exercise to figure out the financial opportunity of moving the low paying customers to list price!

To uncover whether or not this is the case in your company, we suggest putting together a price plot. Simply plot realized price against some measure of the sale of your product, for example price versus volume. If you are like most of companies when we first start working with them, this will resemble a shot gun blast. It is then generally a simple exercise to figure out the financial opportunity of moving the low paying customers to list price!

Addressing this price leakage is generally the first stage of a pricing project and can have a huge impact on profitability. If your customer’s procurement organization is in charge of your dynamic pricing, you can bet that it is not working in your interest! To regain control, reestablish pricing controls and train your sales force on Negotiating with Backbone techniques. Dreams of dynamic pricing are all well and good, but make sure you are able to execute simple segmented pricing first!

.jpg)